March 2024 has arrived, and for most Resident Aliens (RAs) and Nonresident Aliens (NRAs) in the United States, it's another tax season. However, in distant places, there's a group of friends who, for various reasons, have obtained an ITIN, and now they are in a dilemma about whether to file their taxes.

For those who have used their ITIN to open U.S. bank accounts and credit cards, it is actually necessary to continue filing taxes online with their ITIN every year, otherwise, they might face the problem of their ITIN expiring.

Regarding ITINs, generally, according to the explanation on the IRS website, you can see the expiration standards. (The claim of expiration after 5 years was not found in the current terms.)

- If your ITIN was issued before January 1, 2013, and has not been used for at least one federal tax return since then, it needs to be updated.

- ITINs with middle digits of 70, 71, 72, 73, 74, 75, 76, 77, 78, 79, 80, 81, 82, 83, 84, 85, 86, 87, or 88 need to be updated.

- From December 31, 2023, if your ITIN has not been used at least once for federal income tax filing in the 2020, 2021, or 2022 tax years, it will expire.

- If you receive a CP-48 Notice from the IRS, this means you need to update your ITIN.

Back to the main point, everyone should report their taxes, as filing taxes is generally very simple. Before doing this, you need to log into the IRS.GOV website. Since IRS.GOV uses ID.ME for verification, for most people, you need to register with ID.ME and upload your passport, ITIN confirmation letter, and bank statement as proof. After passing a very simple video verification, you can complete the identity verification and then log into IRS.GOV.

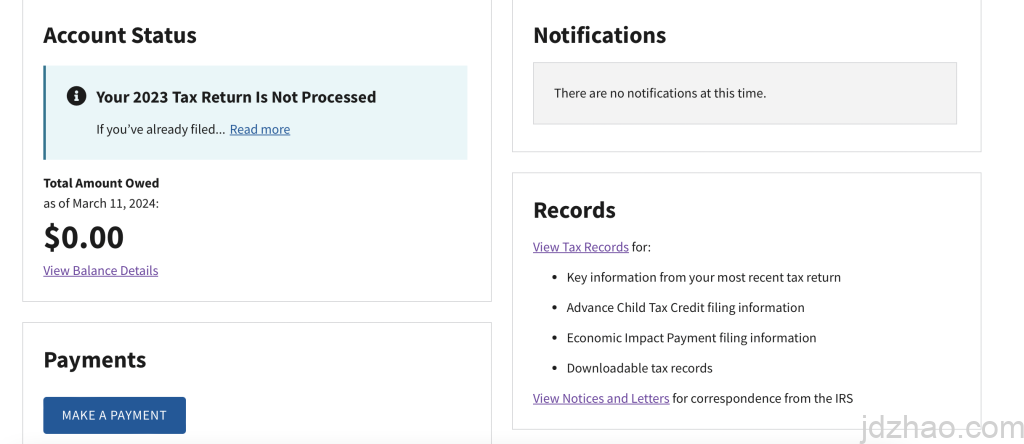

Once logged in, you can see your tax filing status and any amounts owed.

Now that the preparation is done, the tax filing tool I used is olt.com.

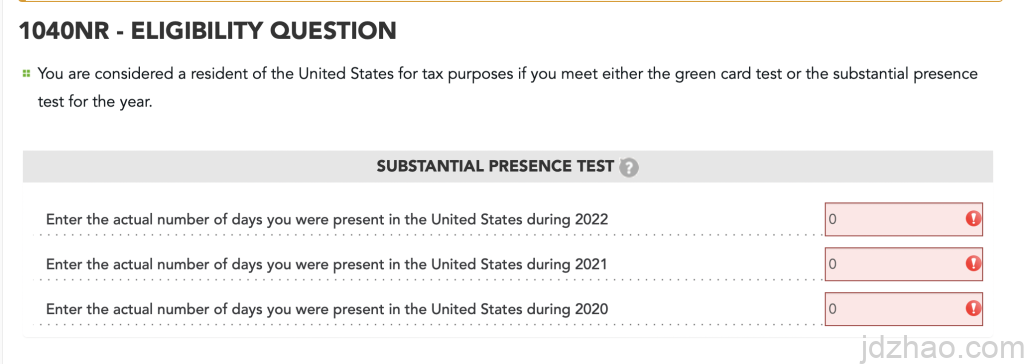

Likewise, you need to register and fill in some information. Importantly, you must ensure you are filling out the Form 1040NR (U.S. Nonresident Alien Income Tax Return). Be sure to confirm the number of days you have lived in the U.S.; you must fill this out truthfully as it can affect your NRA status. It's normal if the total is zero.FORM 1040NR – U.S. Nonresident Alien Income Tax Return),大家最终的时候一定要确认一下。居住天数,必须如实填写,不然会影响NRA身份,全是0也是正常的。

There are many detailed tutorials online, but I will mention a few points that NRAs should pay attention to.

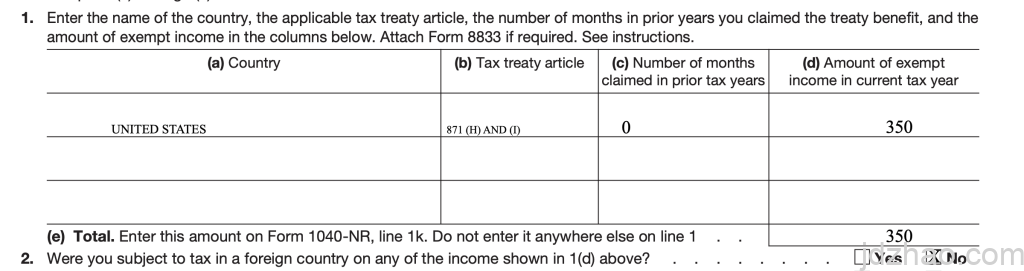

Regarding income, many friends received the Form 1099-INT. After following the instructions and guidelines, you should choose tax relief benefits. The default tax is 30%, which is too expensive if you're dealing with, say, a $350 reward from CAPITAL ONE. NRAs are not supposed to need this; when entering exemption information, please make sure not to choose Chinese tax benefits! Since OLT.COM cannot submit electronically, choose the United States!! This is because NRAs are exempt. Write down the clause 871(H) and (I)!

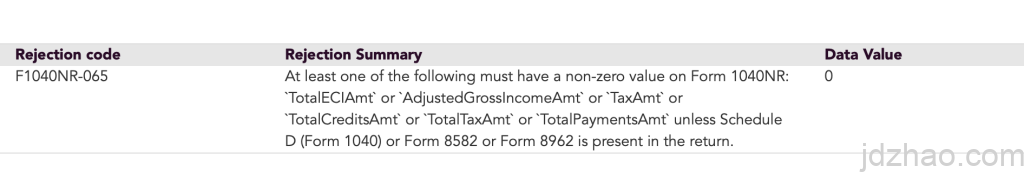

If you only have a 1099-INT form and no 1042-S form for a tax refund, then eventually, you will end up with a 1042NR form with zero tax. If you attempt to submit this, you will be rejected! The error code is F1040NR-065! The reason is that you cannot file a zero report electronically. You have the option to print it out and mail it yourself.

Another alternative is to report additional income, such as gifts and rewards, which you can fill out according to your specific circumstances.

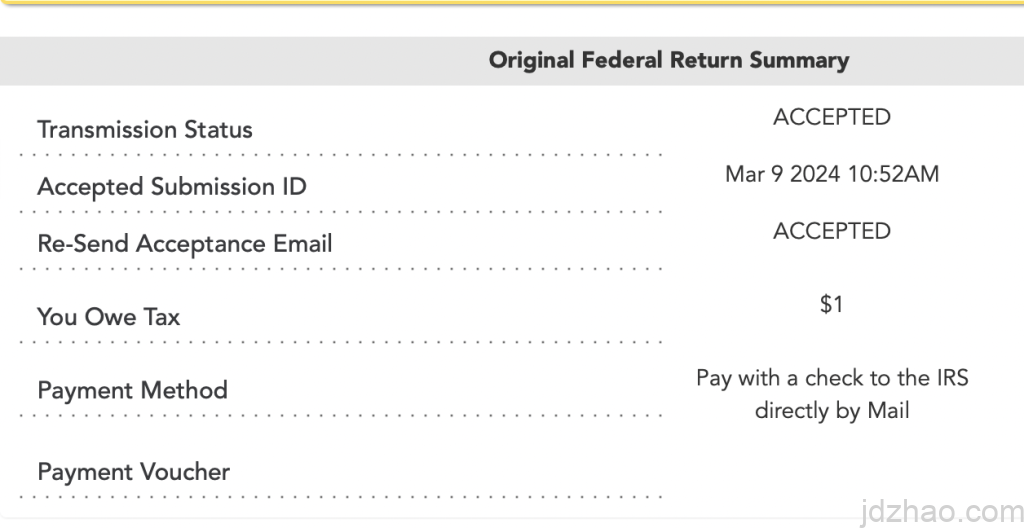

In the 'other income' section, choose gifts and rewards (or others, such as money earned from a website, just describe the income content), fill in the amount, like $10 (you can fill this out based on the rewards you didn't receive from account openings or credit card rewards, confirming you didn't receive a 1099 tax form), then the tax you need to pay would be $1. At this point, you can submit and it will be accepted, as shown in the illustration.

So, the tax filing for 2023 is completed, especially for those who received both 1099-INT and 1042-S forms, please be sure to file taxes, because receiving these forms means the IRS has also received them. Generally, after acceptance, wait for 15-30 days, log in to the IRS website, and make the payment.

Pingback: IRS报税完成后,如何查询报税记录 – 重光阁-Jundong's Blog