A while ago, I published an article about filing my personal taxes for 2023, see "The Thing About NRA Tax Filing: Successful Tax Filing for Cloud Residents with ITIN."《NRA报税那点事:云居民itin报税成功》

Yesterday, when I logged into the IRS website, I found a blank page. So, did I successfully complete my taxes, or did my tax filing fail?

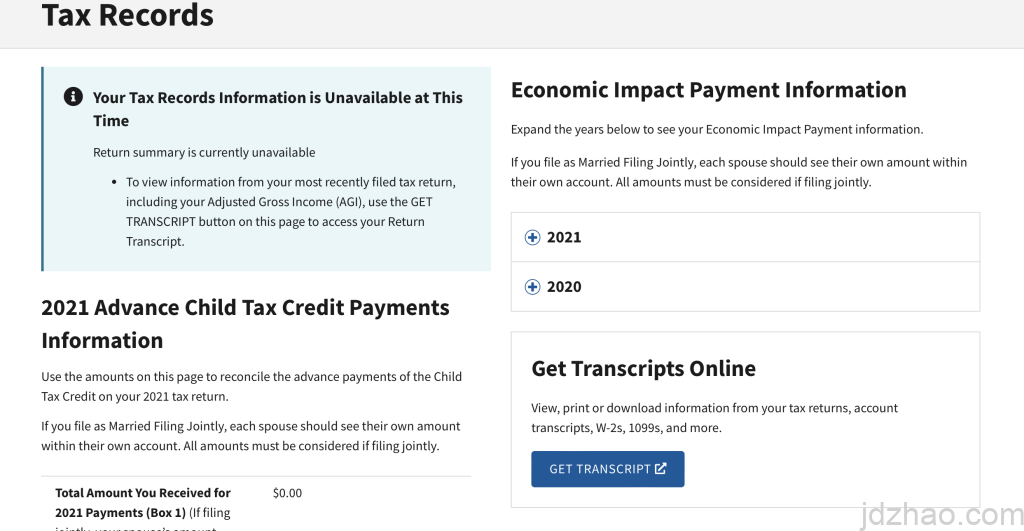

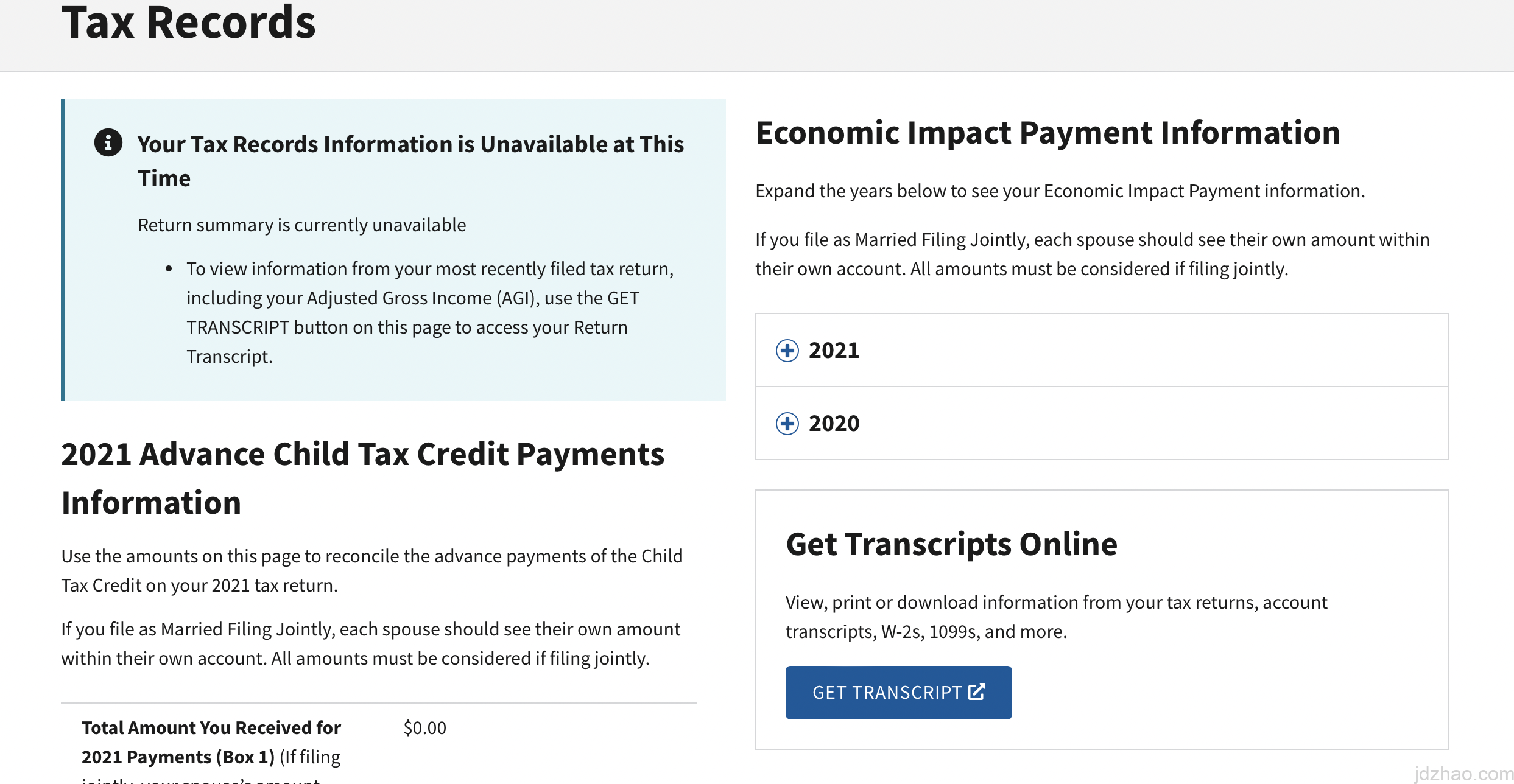

Actually, there is a place where you can check this in advance. We click on "TAX RECORDS," and then click on "GET TRANSCRIPT."

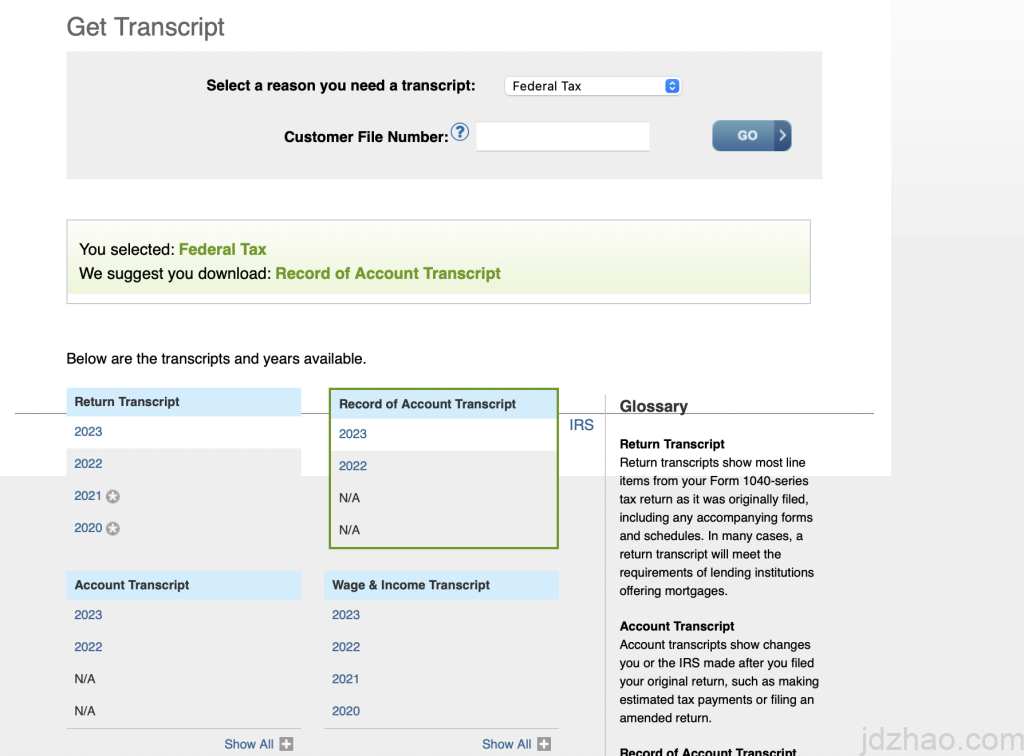

Select a reason for viewing the records, such as "FEDERAL TAX," and click "GO." Then, various years will appear below; choose the "RECORD OF ACCOUNT TRANSCRIPT" for 2023.

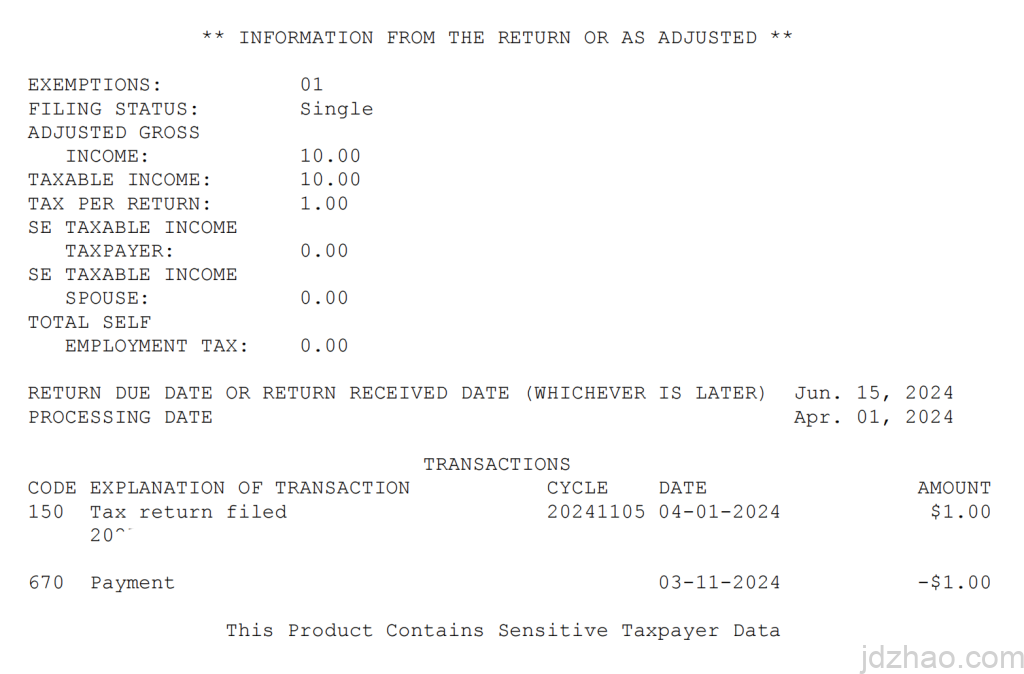

From the screenshot below, you can see the taxes you should have paid and the offset balance (PAYMENT).

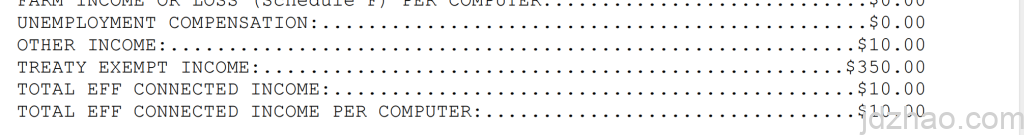

还可以看到自己提报的1042NR表的内容,比如我在前文提到的,350刀的利息,10美元的其他收入,等等

祝大家好运~

Leave a Reply